s corp tax calculator nyc

Electing S corp status allows LLC owners to be taxed as employees of the business. Our calculator will estimate whether electing S corp will result in a tax win for your business.

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Being Taxed as an S-Corp Versus LLC.

. The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1 2021. The following security code is necessary to. In order to gain New York tax-exempt status a corporation must qualify as a 501c and obtain a Nonprofit Tax-Exempt ID Number from the IRS.

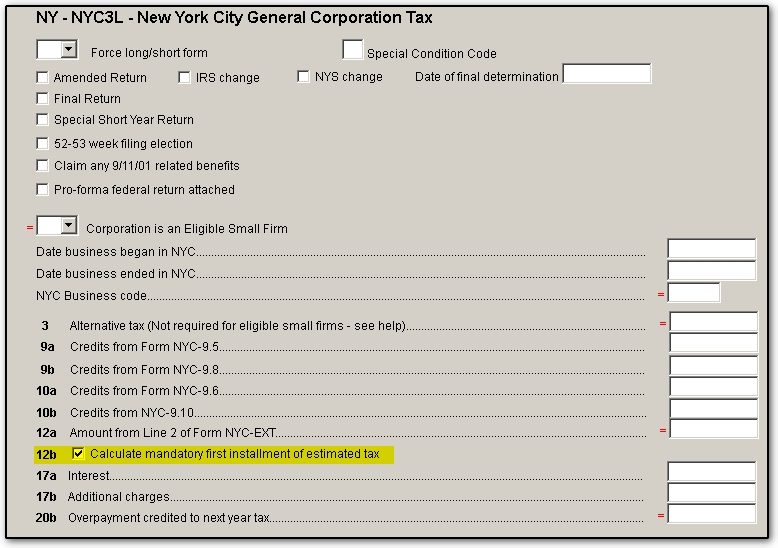

Check each option youd like to calculate for. However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885. Lets start significantly lowering your tax bill now.

However if you elect to. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. This could potentially increase the S-corp tax bill significantly and.

All shareholders who earn wages or a salary from a C Corporation must pay self-employment tax. Enter your info to see your take home pay. More than 500000 but not over 1 million.

As the Big Apple imposes. Ad Easy To Run Payroll Get Set Up Running in Minutes. What percent of equity do you own.

This tax is administered by the Federal Insurance Contributions. Forming an S-corporation can help save taxes. Total first year cost of S-Corp.

Another way that corporations can be taxed is directly on their business capital less certain liabilities. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York.

This calculator helps you estimate your potential savings. S Corp Tax Calculator - S Corp vs LLC Savings. Cooperative housing corporations 04.

S Corp Tax Savings Discover possible tax savings by comparing S Corp to LLCs in your state. Annual state LLC S-Corp registration fees. For example if you have a.

This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022. Start Using MyCorporations S Corporation Tax Savings Calculator.

New York Estate Tax. New Yorks estate tax is based on a. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

Smaller businesses with less net income will only have to pay 65. Taxes Paid Filed - 100 Guarantee. Rate in Tax Year 2015 and thereafter.

This allows owners to pay less in self. Taxes Paid Filed - 100 Guarantee. Use this calculator to get started and uncover the tax savings youll.

If your business is incorporated in New York State or does. S corp vs llc tax savings calculator. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the.

From the authors of Limited Liability Companies for Dummies. This guide will quickly teach you the major mechanics of how your taxes and this tax calculator. The SE tax rate for business owners is 153 tax.

The portion of total business capital directly. Penalty and Interest Calculator. Enter the security code displayed below and then select Continue.

New York may also require nonprofits to file. Partnership Sole Proprietorship LLC. All other corporations 15.

Ad Easy To Run Payroll Get Set Up Running in Minutes. SmartAssets New York paycheck calculator shows your hourly and salary income after federal state and local taxes. We are not the biggest.

Annual cost of administering a payroll. Federal Taxes for C Corps. Estimated Local Business tax.

S Corp Tax Calculator Llc Vs C Corp Vs S.

Ny State And City Payment Frequently Asked Questions

What Is The Average Co Op Flip Tax In Nyc And Who Pays It By Hauseit Medium

Ny State And City Payment Frequently Asked Questions

Creative Director Salary In New York City Ny Comparably

New York City Taxes A Quick Primer For Businesses

What Is The Basic Star Property Tax Credit In Nyc Hauseit

Is It Worth Buying A Coop In Nyc Hauseit Nyc Buying A Rental Property Buying A Condo

Nyc Buyer Closing Cost Calculator Interactive Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

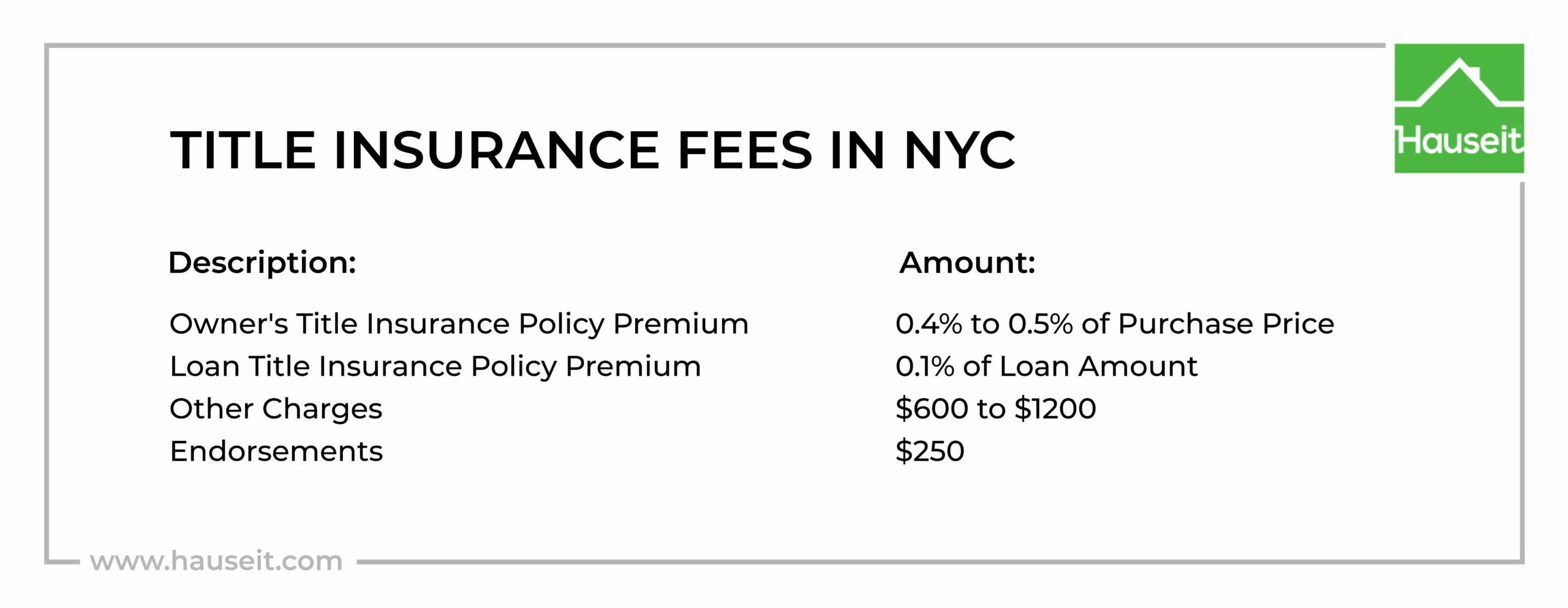

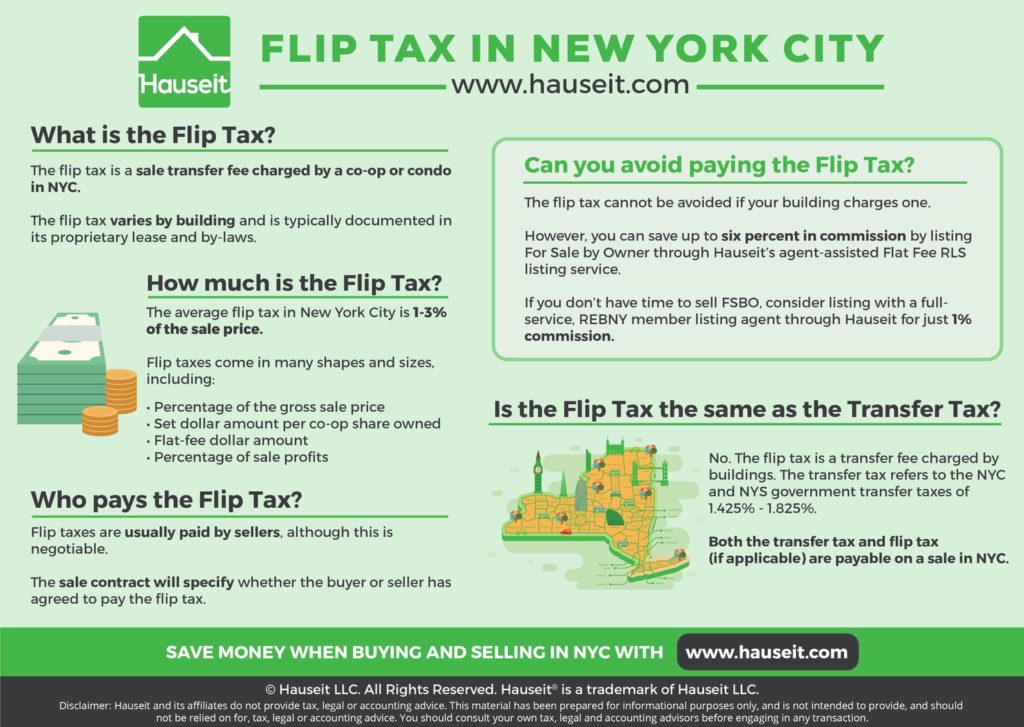

Flip Tax In Nyc What Is The Average Flip Tax And Who Pays It Hauseit

Co Op Maintenance Tax Deduction Calculator Interactive Hauseit

New York City Taxes A Quick Primer For Businesses

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Chinese Microsoft Windows 8 Consumer Preview Screenshots Leak Microsoft Microsoft Windows Windows